To All Shareholders

We would like to express our deep gratitude to shareholders for your continued support of the Aoyama Trading Group.

During the fiscal year under review, the Japanese economy is expected to continue its moderate recovery, supported by improvements in the employment and income environments and the effects of various policies. On the other hand, there are concerns about the risk of a downturn in the economy due to a decline in consumer confidence caused by continued price increases and the impact of policy trends in the United States.

Under these circumstances, the Group's performance posted steady sales in Business Wear Business and Franchisee Business, while sales in Printing and Media Business and Sundry Sales Business declined year on year. In addition, the impact of the income tax adjustment recorded in the previous year was negligible in the current year.

As for the return of profits to shareholders during the new Medium-Term Management Plan period from the fiscal year ending March 31, 2025 to the fiscal year ending March 31, 2027, the Company's basic policies are to actively and stably return profits to shareholders while investing in growth to maintain and strengthen competitiveness and working to improve earning capacity and strengthen its financial position.

In addition, to realize management that is conscious of the cost of capital and the share price, and to further advance initiatives to increase corporate value, we will adopt the higher of the consolidated dividend payout ratio of 70% or the dividend on equity ratio (DOE) of 3% and we will improve capital efficiency and increasing dividends over the mid to long term and pay dividends through profit growth.

We look forward to the continued support of our shareholders.

General Outline

Business results for the current period

(¥ Millions)

Net Sales |

Operating income or loss(▲) |

|||||||

|---|---|---|---|---|---|---|---|---|

Segment |

Current term |

Previous term |

Increase (decrease) |

Year-on-Year(%) |

Current term |

Previous term |

Increase (decrease) |

Year-on-Year(%) |

Business wear businness |

133,109 |

133,210 |

▲101 |

99.9 |

8,927 |

7,807 |

1,119 |

114.3 |

Credit card business |

5,265 |

4,959 |

305 |

106.2 |

1,977 |

2,026 |

▲48 |

97.6 |

Printing and media business |

10,956 |

11,452 |

▲495 |

95.7 |

▲177 |

124 |

▲301 |

- |

Sundry sales busineaa |

15,113 |

15,232 |

▲118 |

99.2 |

141 |

245 |

▲104 |

57.6 |

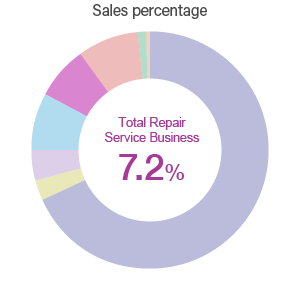

Total repair service business |

14,130 |

13,362 |

767 |

105.7 |

161 |

171 |

▲10 |

94.0 |

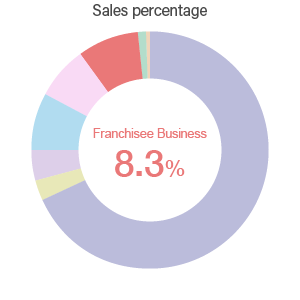

Franchisee Business |

16,214 |

15,157 |

1,056 |

107.0 |

1,118 |

1,090 |

27 |

102.5 |

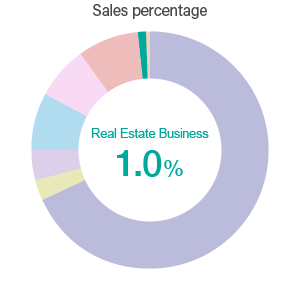

Real Estate Business |

2,984 |

3,066 |

▲82 |

97.3 |

578 |

557 |

21 |

103.9 |

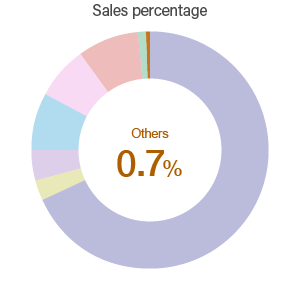

Others |

1,110 |

1,489 |

▲378 |

74.6 |

▲284 |

▲254 |

▲29 |

- |

Adjustments |

▲4,094 |

▲4,243 |

149 |

- |

129 |

149 |

▲19 |

86.8 |

Total |

194,790 |

193,687 |

1,102 |

100.6 |

12,573 |

11,918 |

654 |

105.5 |

Review of Operations

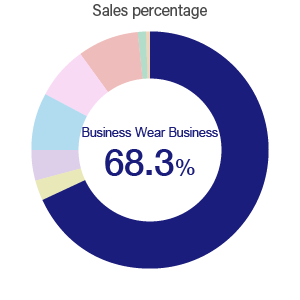

Business Wear Business

Aoyama Trading Co., Ltd. Business Wear Business, Blue Reverse Co., Ltd. MDS Co., Ltd., Eisho Co., Ltd., FUKURYO Co., Ltd. and Aoyama Suits (Shanghai) Co., Ltd., Melbo Men's Wear, Inc.

Sales in this segment were 133.109 billion yen (down 0.1% year on year), and segment profit (Operating profit) was 8.927 billion yen (up 14.3% year on year). In the Aoyama Trading Co., Ltd. Business Wear Business, which is the core segment of this business, the custom-made suit brand "Quality Order SHITATE" performed steadily, and the functional set-up suit "Zero Pressure Suit," which is easy to use for casual styles, became popular. We have implemented various measures, including the development of a new ladies' style. As a result of these efforts, net sales at existing stores in Business Wear Business were down 0.4% year on year. The number of men's suits sold was 1.048 million (down 10.7% year on year), and the average unit sales price was 34,076 yen (up 7.3% year on year). Segment profit increased from the previous year due to the efficient use of expenses related to sales promotion.

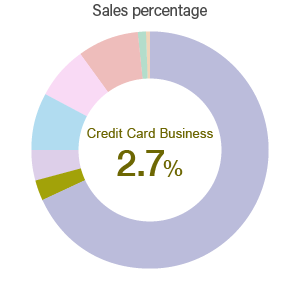

Credit Card Business

Aoyama Capital Co., Ltd.

In this segment, sales were 5.265 billion yen (up 6.2% year on year), and segment profit (operating profit) was 1.977 billion yen (down 2.4% year on year), due to an increase in sales promotion expenses and other factors, despite an increase in shopping transaction volume as a result of various campaigns. The Company procures funds through borrowings from its parent company, Aoyama Trading Co., Ltd., etc., and issuance by Bonds payable.

Number of effective members are 3.85 million as end of February 2025.

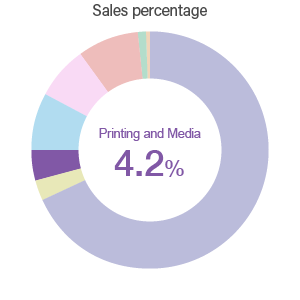

Printing and Media Business

ASCON Co., Ltd.

In this segment, sales were 10.956 billion yen (down 4.3% year on year), and segment loss (operating loss) was 177 million yen (segment income (operating income) of 124 million yen in the previous fiscal year), mainly due to decreases in printing and DM sales and device-related sales, as well as a decrease in gross profit sales due to a rise in costs.

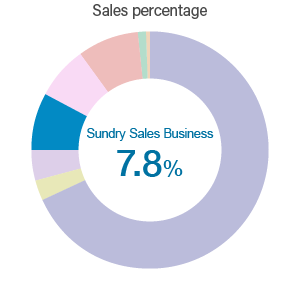

Sundry Sales Business

Seigo Co., Ltd.

In this segment, sales were 15.113 billion yen (down 0.8% year on year), and segment profit (operating profit) was 141 million yen (down 42.4% year on year), due to the closure of unprofitable stores and the impact of soaring costs, despite year-on-year increases in existing store sales. As of the end of February 2025, there were 101 stores.

Total Repair Service Business

Minit Asia Pacific Co., Ltd.

In this segment, sales were 14.13 billion yen (up 5.7% year on year), and segment profit (operating profit) was 161 million yen (down 6.0% year on year). This was mainly due to the aggressive promotion of franchise stores in the overseas business and new services in the Japan business, such as suitcase caster replacement and umbrella repair services, which compensated for a decrease in sales in the mainstay shoe repair business.

Franchisee Business

glob Co., Ltd.

In this segment, sales were 16.214 billion yen (up 7.0% year on year), and segment profit (operating profit) was 1.118 billion yen (up 2.5% year on year), both record highs, due to year-on-year increases in net sales at existing stores in each business category and steady progress in store openings.

Real Estate Business

Aoyama Trading Co., Ltd. Real Estate Business

In this segment, sales were 2.984 billion yen (down 2.7% year on year), and segment profit (operating profit) was 578 million yen (up 3.9% year on year).

Others

WTW Corporation, Customlife Co., Ltd.,

In the Other Businesses segment, sales were 1.11 billion yen (down 25.4% year on year), and segment loss (operating loss) was 284 million yen (254 million yen in the previous fiscal year). As of March 31, 2025, there were eight WTW stores.

June 26, 2025

President