Shareholder Return Policy

The Company will return profits to shareholders based on policies set for each of the Medium-Term Management Plan.

As for the return of profits to shareholders during the new Medium-Term Management Plan period from the fiscal year ending March 31, 2025 to the fiscal year ending March 31, 2027, the Company's basic policies are to actively and stably return profits to shareholders while investing in growth to maintain and strengthen competitiveness and working to improve earning capacity and strengthen its financial position.

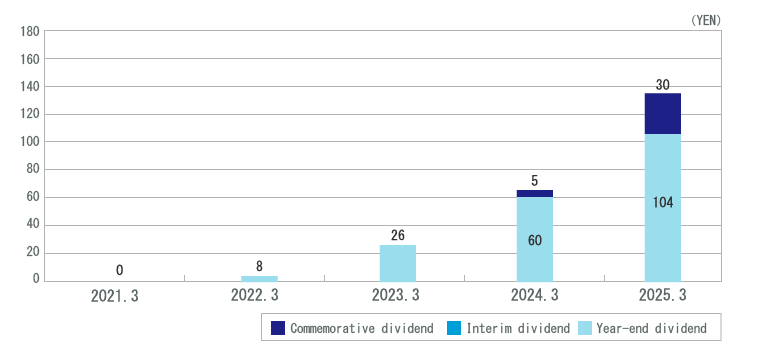

In addition, to realize management that is conscious of the cost of capital and the share price, and to further advance initiatives to increase corporate value, we will adopt the higher of the consolidated dividend payout ratio of 70% or the dividend on equity ratio (DOE) of 3% and we will improve capital efficiency and increasing dividends over the mid to long term and pay dividends through profit growth.

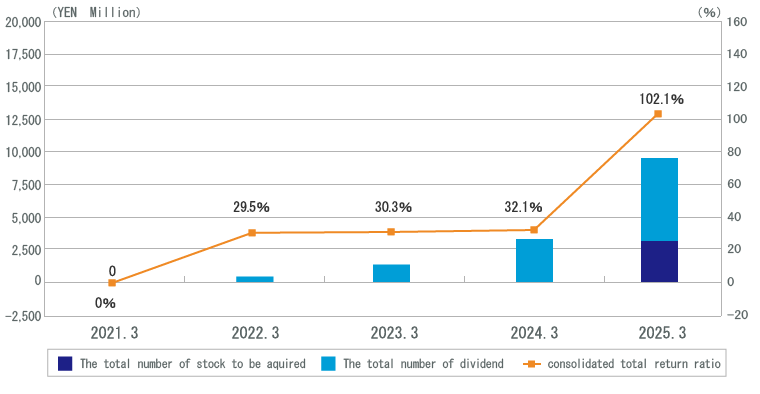

The company will flexibly conduct share repurchases with the aim of improving capital efficiency, while taking into account business performance, capital conditions, and market conditions, including stock prices.

During the period of the Medium-Term Management Plan, the company will purchase up to 10 billion yen of its treasury share.

Transition of a dividend